Calculate interest only payments on line of credit

Personal line of credit. You can find various types of loan calculators online including ones for mortgages or other specific types of debt.

Emi Calculator For Personal Loan Personal Loans Loan Consolidation Loan

A loan calculator is an automated tool that helps you understand what monthly loan payments and the total cost of a loan might look like.

. In the fourth quarter of 2020 only 037 of mortgages from borrowers with impaired. It can also display one additional line based on any value you wish to enter. This open-ended line of credit allows homeowners to borrow and repay money repeatedly.

Minimum payments will also vary by the card issuer depending on the card issuers approach to generating profits. Because interest payments on your primary residence are tax-deductible for loans up to 750000 100 percent of your interest-only mortgage is tax-deductible if you itemize. Multiply the average outstanding balance by the interest rate to get annual.

Federal loans generally have a standard repayment schedule of 10 years. For example if you have an APR of 65 you will create this equation. You should also know how long the life of your line of credit will be as well as the ceiling.

If the same company takes on debt and has an interest cost of 500000 their new EBT will be 500000 with a tax rate of 30 and their taxes payable will now be only 150000. Learn more Reserve line of credit. In order to calculate your home equity line of credit payment youll need to understand your HELOC rates when the rate becomes variable and whether you will have an opportunity to only pay your interest payments during a certain period of time.

1500000 50 750000. Example on how to calculate payments. The principal is the original loan amount not including any interest.

Based on the given information you must calculate the line of credit interest payment for October 2019 assuming this bank uses the average daily balance concept. You can calculate it on your own or use an online loan payment calculator or work directly with a loan officer. Additional Resources Thank you for reading CFIs guide to Interest Expense.

Using the Line of Credit Payoff Calculator. You can use available credit as needed and only pay interest on the funds you borrow. Outstanding to calculate the average loan balance for the entirety of the construction term.

Calculating Credit Card Interest. The effect that new monthly charges on your line of credit will have on repaying the loan. For every 100 borrowed you pay a 6 fee.

These payments are based on a percentage of the total balance making them easy to calculate once you understand how they work. Your card issuer may use a daily interest method or assess interest monthly based on an average balance for example. HELOCs typically have a variable interest rate monthly payments and a credit limit.

Will have to be entered as a monthly interest rate. The calculator is fairly straightforward. The calculation for credit cards is similar but it can be more complicated.

Where loans have a set payment each month that accounts for equity and interest a line of credits payment is different each time. It also generates a printable amortisation schedule of your monthly mortgage payments. This free online calculator will calculate the monthly interest-only HELOC payment given your current balance plus calculate the principal and interest payment that will take effect once the draw period expires.

There are several ways to calculate your monthly auto loan interest payment. For example lets suppose you purchase a 350000 home and put down 50000 in cash. The impact that making up to four new draws against your line of credit of varying amounts and on a irregular schedule will have on repaying the loan.

Interest rate 1 as a percentage Minimum interest rate. With the inputs complete the tool will perform the following calculation to estimate the interest reserve. Your loan repayment term is the number of years you have to pay it back.

If you use your home or other assets to secure your loan or line of credit youll get more credit likely a lower interest rate and repayment options that work for you. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. Multiply the loan amount by the Avg.

This is known as the periodic interest rate or daily interest rate. 7 Average Tally member line of credit APR 1499 and credit card APRs 22 calculated in May 2022 for member accounts active during January 1 2021 - March 1 2022. A decrease in home value could affect the revolving credit limit.

6 The portion of your credit line that can be paid to your cards will be reduced by the amount of the annual fee. You can compare interest-only payments and fixed-rate loans side by side. The loan calculator on this page is a simple interest loan calculator.

Your student loan repayment term. They also have a good credit history showing on-time payments without large outstanding balances. To calculate credit card interest divide your interest rate or APR by 365 for each day of the year.

2 For private student loans the repayment term can range anywhere from 5-20 years depending on the loanYoull be given a definite term for your loan when you apply. If you borrow 400 your fee will be 24. Because the interest rate listed on your credit card statement is an annual rate but this calculation requires the monthly interest amount calculate the interest within the cell by dividing the interest rate by the number of months in a year 12.

A HELOC usually has a fixed amount of time borrowers can withdraw money before a final repayment period. The only variable you will. For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three.

Since there is no fixed formula to calculate interest on the line of credit it depends from bank to bank and here they are charging based on the average daily balance. If you would like to calculate the size of the home equity line of credit you might qualify for please visit the HELOC Calculator. Enter the interest rate for your credit card balance in column B next to the Interest rate label.

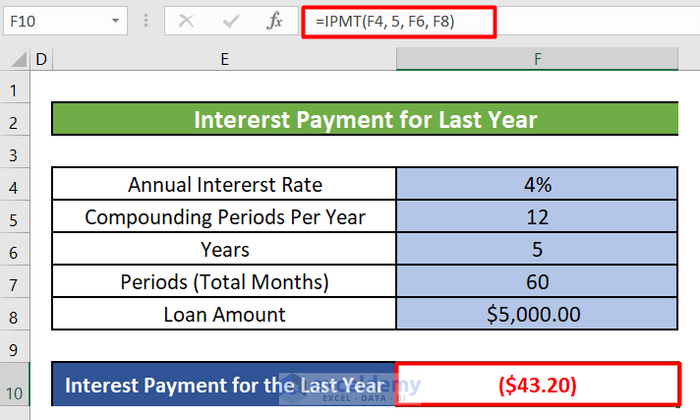

How To Calculate Interest On A Loan In Excel 5 Methods Exceldemy

Personal Business Loans Webmasters Amortization Calculator Will Bring Sale Amortization Schedule Loan Repayment Schedule Excel Templates

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Excel Formula Calculate Loan Interest In Given Year Exceljet

Advanced Loan Calculator

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Line Of Credit Tracker Line Of Credit Personal Financial Statement Student Loan Interest

Pin Su Loans Calculator Iphone Application

Simple Loan Calculator

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

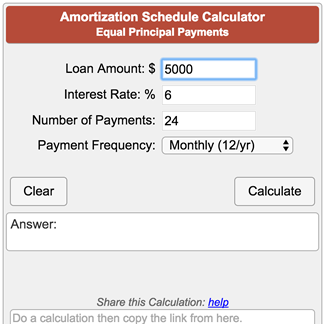

Amortization Schedule Calculator Equal Principal Payments

Interest Only Mortgage Calculator

Interest Only Home Loan Calculator With Money Saving Idea Interest Only Mortgage Mortgage Payment Mortgage Payment Calculator

Heloc Mortgage Accelerator Spreadsheet Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

Free Interest Only Loan Calculator For Excel